The deal lifecycle is a multi-step process; sending out presentations and quotes is just the beginning. It’s hard to count the number of deals that fail each year because companies don’t quite understand what to do next. Today’s technology solutions offer businesses more options for streamlining document management and deal tracking. One such solution is DockSend, a product from Dropbox that eliminates the most frequent transaction and data management processes. This article will look at how DocSend can be useful during deal closeout.

Load documents into DocSend

Moving documents to DockSend isn’t difficult, especially if you’re already a Dropbox user, but if you’re using another platform provider to share documents, there’s nothing wrong with that. Uploading data is quick, easy, and smooth. To do this you need to:

- Connect to Dropbox – you can do this in a few clicks. The platform can also work with other online storage accounts, such as Google Drive, Box, and Microsoft OneDrive

- Send documents to the platform instantly-when you successfully connect, you’ll be able to see your entire catalog of files. To upload them to the platform, all you have to do is double-click on the document

- Deliver the upload – merge and send multiple files at once to save your time. No need to convert the files yourself because the provider supports all types of documents

Set limits for your documents

During a transaction, companies often need to exchange sensitive documents, but they need to be as secure as possible. During transactions, data becomes more vulnerable, and this is when most data leaks occur. DocSend has additional security control options that allow for increased protection:

- Password protection feature -Space administrators can set expiration dates for documents, after which users could no longer have access to the record. The platform also offers access codes that can be placed on any document

- Spectator Validation Options – allow you to find out detailed information about who has access to your data. When logging into a document, users must provide their email address to proceed

- Watermarks – Dynamic watermarks allow you to protect your copyrights. They can be placed on documents, even presentations, and videos. Watermarks provide information about all the users who entered the document

Share documents securely and speed up the transaction process

Building a good business partnership is very important in a successful transaction. With DocSend, you can customize your data room to match your company’s brand and organize a personalized experience for your partners. In addition, you can collaborate with multiple stakeholders, creating separate data rooms for them to collaborate and share content. The entire process will take place in a streamlined and secure space.

Keep track of your documents

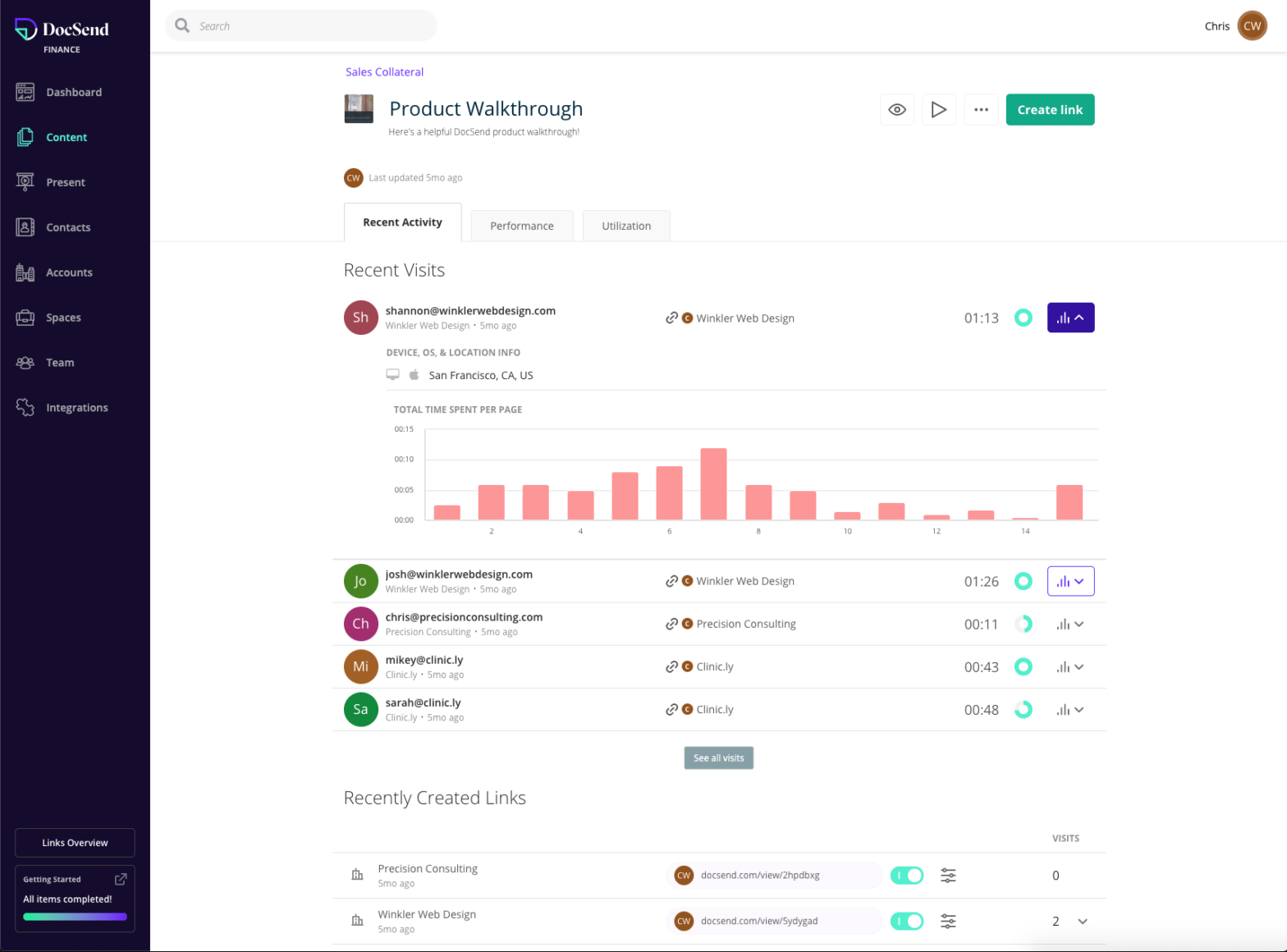

DocSend gives you useful analytics and insights into your invited users and how they use documents. The platform offers:

- Page analytics are analytics that let you know which pages of documents users spend the majority of their time on. So you can see the aspects that your potential customers or partners have the most problems with, reach out to them promptly and answer all their questions and concerns. It also helps to track user engagement levels

- Automatic notifications – With DocSend, you can get notifications when someone views your shared links. That way, you can learn more about the status of your deal and which stakeholder you should be paying more attention to.